Why Investing in Travel and Tourism Is a Smart Move

Introduction to the Global Travel and Tourism Industry

Overview of the sector’s growth trajectory

Let’s kick things off with the big picture. The global travel and tourism industry is a powerhouse. We’re talking trillions of dollars. It contributes over 10% to the global GDP and supports more than 300 million jobs worldwide. Yes, it took a massive hit during the COVID-19 pandemic, but it bounced back stronger—resilient, restructured, and re-energized. If that’s not the definition of a winning investment sector, I don’t know what is.

The sector includes everything from airlines, hotels, cruise ships, attractions and online booking platforms to tour operators, travellers and local guides. That diversity alone creates multiple investment streams. You’re not tied to just one path—you’ve got options, whether you’re a big-time investor or just dipping your toes in.

And let’s not ignore the digitization of travel. With tech disrupting every corner of the industry—AI-powered travel agents, contactless check-ins, and even virtual travel experiences—it’s an investor’s playground. According to the United Nations World Tourism Organization (UNWTO), international tourist arrivals are expected to reach 1.8 billion by 2030. It’s not just travel; it’s transformation.

Economic contribution on a global scale

When people travel, money flows. Travelers spend on accommodations, dining, transport, entertainment, and even retail. This spending trickles down into local economies, empowering communities and creating job opportunities. In many developing nations, tourism is a top foreign exchange earner and a critical part of their economic fabric.

International tourism receipts totaled over $1.4 trillion pre-pandemic and are rapidly climbing back up. As global connectivity improves with new air routes and digital nomads continue to roam, the sector’s economic footprint expands even further. This means governments are more incentivized to back tourism-related projects, often sweetening deals for investors with tax breaks and infrastructure support.

Rising Demand for Unique Travel Experiences

The shift from materialism to experientialism

Here’s the thing—people are over-collecting “stuff.” Instead, they want to collect memories. That’s why travel experiences are booming. From sleeping under the Northern Lights in an igloo to cooking pasta in an Italian grandmother’s kitchen, travelers crave authenticity, not just luxury.

You can also read: Top 5 Unforgettable Foodie Getaways

This shift has sparked an explosion in experience-driven businesses. Airbnb Experiences, for example, allows locals to monetize their skills, whether it’s street photography tours or yoga in the jungle. These small-scale niche services are scaling globally and raking in serious profits.

As investors, this pivot means more opportunities in boutique travel companies, cultural retreats, and hyper-local services. It’s not about owning a chain of hotels anymore—it’s about curating moments. Experiences are the new currency, and this trend is not slowing down anytime soon.

Millennials and Gen Z are fueling demand

Millennials and Gen Z are changing the game. These generations value experiences over assets and are willing to spend more on unique, shareable moments. Social media has supercharged this behavior. If it’s not “Instagrammable,” it might not make the cut. This constant pursuit of fresh content fuels travel trends faster than ever.

According to recent surveys by the World Economic Forum, more than 72% of Gen Z travelers prefer spending money on travel rather than on physical goods. They also prioritize sustainability and purpose in their travels, creating a market for eco-friendly and ethical tourism. What does this mean for investors? A goldmine of untapped potential. Travel apps, sustainable hostels, adventure gear, you name it—if it caters to these generations, it’s worth watching.

These generations are also digital-first, relying heavily on platforms like TikTok and YouTube for travel inspiration. This makes digital marketing and influencer-backed travel startups prime candidates for investment. If your portfolio isn’t speaking to Gen Z and Millennials yet, it’s time to tune in.

Post-Pandemic Boom: A New Era of Travel

Revenge travel and pent-up demand

“Revenge travel” became the buzzword of 2022, and for good reason. After years of lockdowns and canceled plans, people were itching to go anywhere. That surge of travel didn’t just fade away—it ignited a movement. Now that borders are open and travel restrictions have eased, this demand continues to climb.

Hotels are booked, flights are full, and travel-related services are booming. In fact, airline bookings in some regions have exceeded pre-pandemic levels. This rebound proves that travel isn’t a luxury—it’s a necessity for many. For investors, it’s a green light. The demand is there, the customers are ready, and the market is wide open.

More importantly, travel patterns have shifted. People are staying longer, spending more, and exploring off-the-beaten-path destinations. All of this fuels new segments of growth—boutique stays, alternative transportation, and personalized tours—and opens doors for innovation-driven investments.

Evolving safety standards and tech integration

The pandemic didn’t just change where people go; it changed how they go. Touchless check-ins, mobile health passports, and digital boarding have all become the norm. Health and hygiene aren’t just buzzwords anymore—they’re a critical part of the travel experience.

Travel companies that quickly adopted new safety tech are leading the pack. For investors, this means backing companies that are tech-forward, adaptable, and committed to guest safety. Think platforms that integrate real-time health updates, offer seamless booking, and adapt to regulatory changes with ease.

Additionally, biometric security, AI-driven customer support, and virtual reality travel previews are redefining convenience. All these technologies aren’t just improving the traveler’s experience—they’re creating investment opportunities in travel tech, logistics, and SaaS solutions tailored to the tourism sector.

Key Segments Within the Industry to Watch

Adventure and eco-tourism

If you think luxury hotels are the only way to go, think again. Adventure tourism is booming. We’re talking hiking Machu Picchu, diving in the Great Barrier Reef, and exploring the Amazon rainforest. People are actively seeking adrenaline-pumping and nature-connected experiences.

Adventure and eco-tourism are growing at over 20% annually. Travelers want more than just comfort—they want purpose, and nature gives them that. Investors can tap into this by backing eco-lodges, guided adventure services, and gear companies. Plus, many countries offer incentives for promoting ecotourism, adding an extra layer of financial appeal.

You can also read: 10 Tips for Planning the Perfect Adventure Tour

This segment also benefits from minimal infrastructure costs. You don’t need a five-star hotel to run a successful ecotour business. Sometimes, a treehouse and a guide with local knowledge are enough. That makes it ideal for low-entry-cost investments with high ROI potential.

Wellness and medical tourism

Wellness isn’t a trend—it’s a lifestyle. From yoga retreats in Bali to medical procedures in Thailand, wellness and medical tourism is growing fast. People travel to feel better, look better, and even heal faster. And the best part? They’re willing to pay a premium for it.

Investments in this sector range from health-focused resorts and spas to cross-border medical facilities that cater to international patients. Countries like India, Mexico, and Turkey are hotspots, offering top-notch medical services at a fraction of the cost seen in the West.

For investors, this segment promises strong returns and stable demand. It’s recession-resistant too—because when it comes to health and wellness, people don’t really cut back. From fertility treatments to detox getaways, this market is ripe for innovation and disruption.

Financial Returns and Growth Potential

ROI trends in travel-related investments

Let’s talk numbers—because at the end of the day, ROI is king. Historically, travel and tourism investments have offered stable and often impressive, returns. Whether you’re looking at hotel chains, cruise lines, or travel-tech platforms, the growth trajectory remains solid. For instance, leading hotel REITs (Real Estate Investment Trusts) have reported average annual returns between 8-12% over the last decade.

Even during turbulent times, such as the pandemic, the companies that adapted quickly—think online booking giants or local staycation providers—bounced back with renewed strength. Post-COVID recovery has sparked a second wave of growth, with travel-related stocks outperforming many other sectors on global exchanges.

There’s also the benefit of diversification. Travel encompasses hospitality, transport, tech, logistics, and experiences. You can spread your investment across different types of assets—each with unique risk-reward ratios. And with the global middle class expanding, especially in Asia and Latin America, more people are traveling than ever before, adding fuel to the growth fire.

Successful case studies and market leaders

Look at companies like Airbnb and Booking.com. These platforms reshaped the travel landscape and created unprecedented investor wealth. Airbnb, for example, went public at a valuation north of $100 billion—proof that innovative business models in travel can explode in value.

Similarly, budget airlines like Ryanair and Wizz Air captured a massive market share by meeting the demand for affordable travel. Their lean business models and regional focus gave them an edge, even during downturns. Investors who got in early saw exponential returns.

But it’s not just the big players. Smaller boutique travel brands, experience curators, and even local tour guides who leveraged digital tools have seen incredible growth. The secret? Flexibility, innovation, and knowing what the modern traveler wants. Investing in companies or startups that reflect these traits is a smart play.

Tourism and Infrastructure Development

How tourism stimulates local economies

Travel is more than just fun—it’s economic oxygen. When tourists flock to a destination, money flows through every level of the community. Think hotels, local restaurants, souvenir shops, taxi services, artisans, and even farmers supplying food to resorts. Every tourist dollar gets multiplied across the local economy.

In emerging markets especially, tourism can be a lifeline. It generates employment, reduces poverty, and fuels entrepreneurship. Governments know this, which is why they often pour money into airports, roads, and attractions to attract more visitors.

This translates into opportunities in construction, retail, real estate, and service industries. Infrastructure projects linked to tourism—like building new hotels, ports, or entertainment centers—often receive favorable treatment from policymakers. Plus, you’re not just making money—you’re contributing to local development. It’s a win-win.

Public-private partnerships and government incentives

To supercharge tourism, many governments form partnerships with private investors. These public-private partnerships (PPPs) offer access to major projects—like airports, convention centers, or national parks—without the typical red tape or high initial costs.

For example, the Maldives has successfully used PPPs to develop luxury resorts on uninhabited islands. Investors lease land from the government and develop high-end resorts, and both parties share the revenue. This model has been replicated in Indonesia, Sri Lanka, and parts of Africa.

Moreover, tax holidays, duty-free import allowances, and low-interest loans are just some of the perks offered to attract tourism investments. Investors who align their vision with national tourism goals often benefit from these sweeteners, making their ventures more profitable and less risky in the long run.

Technology Transforming the Travel Landscape

AI, VR, and big data in travel planning

Tech is flipping the script in the travel industry. From artificial intelligence to virtual reality, the way we plan and experience travel is undergoing a digital revolution. AI chatbots help travelers book trips, answer queries, and even suggest itineraries based on preferences. This automation not only improves customer experience but also slashes costs for companies.

Then there’s big data. Travel platforms use it to predict booking trends, set dynamic pricing, and optimize flight paths. For investors, companies that utilize data effectively offer a serious edge. They’re better equipped to understand their markets and adapt quickly.

Virtual reality (VR) is also creating new experiences. Imagine previewing a hotel room or an entire city through a VR headset before booking. It’s interactive, immersive, and incredibly persuasive for customers. Businesses that adopt these tools are set to lead the next wave of travel tech innovation.

Mobile apps, contactless services, and smart hotels

The smartphone is the modern traveler’s best friend. Everything—from check-in and boarding passes to translation and navigation—is managed through apps. That’s why travel startups focusing on mobile-first solutions are attracting major investment.

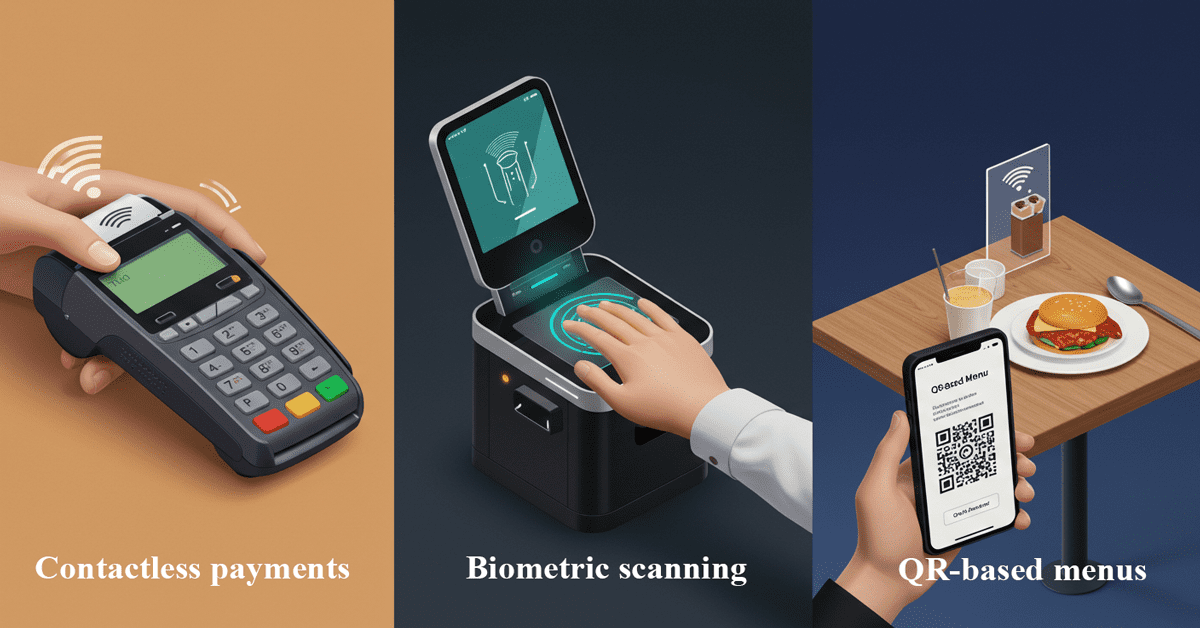

Contactless payments, biometric scanning, and QR-based menus have all become standard post-pandemic. Now, smart hotels are going a step further—offering voice-controlled rooms, app-based keys, and AI-powered concierge services. These features don’t just impress guests—they increase efficiency and lower operational costs.

Investors who back hospitality brands integrating tech into their services are likely to enjoy better margins and stronger customer loyalty. In a competitive market, it’s the tech-savvy brands that are setting themselves apart and leading the charge.

Environmental Sustainability and Green Investment

Eco-conscious traveler trends

Sustainability isn’t just a buzzword anymore—it’s a movement. Travelers, especially younger ones, are more environmentally conscious than ever. They want to know that their vacations don’t come at the planet’s expense. This shift has led to increased demand for eco-friendly accommodations, carbon-neutral transport, and ethical wildlife experiences.

Hotels that recycle water, reduce plastic, use solar power, and source locally are gaining a competitive edge. Many even pursue green certifications, like LEED or Green Globe, to showcase their commitment to the environment. Travelers are happy to pay a premium for this peace of mind.

For investors, this trend opens doors to a new kind of tourism—one that blends profit with purpose. Whether it’s building eco-lodges, funding carbon offset programs, or supporting green startups, there’s a growing market eager for sustainable travel solutions.

ESG strategies for tourism investors

Environmental, Social, and Governance (ESG) principles are becoming essential in investment decisions, and tourism is no exception. ESG-aligned tourism investments are gaining favor with institutional investors and funds focused on long-term value creation.

Green resorts, carbon-neutral airlines, and zero-waste cruises are examples of businesses integrating ESG into their core strategy. They not only reduce environmental impact but also promote community welfare and transparent governance. These factors build brand trust, reduce legal risks, and enhance reputation.

For investors, aligning with ESG doesn’t mean sacrificing returns. In fact, many ESG-focused travel ventures are outperforming traditional ones, thanks to increasing consumer demand and regulatory support. It’s about building a better business—for travelers, communities, and the planet.

Real Estate and Hospitality Ventures

Hotels, resorts, and Airbnb models

One of the most lucrative—and familiar—ways to invest in travel is through hospitality real estate. From traditional hotels to boutique resorts and Airbnb-style rentals, this segment of the tourism industry offers multiple routes for building long-term wealth.

Hotels in high-tourism zones have historically shown strong occupancy rates and consistent cash flow. Luxury resorts, in particular, cater to a premium clientele and command higher margins. Additionally, hotel brands often offer franchising or management contracts, allowing investors to earn from well-established reputations without starting from scratch.

But let’s not overlook short-term rentals. Platforms like Airbnb and Vrbo have made it incredibly easy for investors to turn vacation homes into profitable micro-hotels. These properties typically see higher yields compared to long-term leases, especially in areas with strong tourist traffic.

Even better, travel recovery is reviving urban and rural markets alike. You no longer need a beachfront property in Bali to make a killing—mountain cabins, desert yurts, and even city apartments are in demand. If you’re eyeing real estate investments with flexibility, scalability, and global appeal, tourism assets are worth every penny.

Timeshares and co-living vacation spaces

Timeshares may have once had a bad rap, but modern models are making a comeback. Today’s timeshare programs are more flexible, often part of high-end resort brands, and offer global exchange networks. Buyers aren’t tied to one location—they can choose from hundreds of destinations. This flexibility makes them more appealing and reduces churn.

Co-living vacation spaces are also heating up. These are properties where digital nomads or like-minded travelers can work, stay, and socialize under one roof. Think of it as a WeWork meets Airbnb fusion. With the rise of remote work, this hybrid of hospitality and community living is catching on quickly—especially in cities with strong Wi-Fi and lifestyle appeal like Lisbon, Medellín, or Chiang Mai.

Both timeshares and co-living models offer strong returns with relatively lower overhead. It’s an opportunity to tap into evolving preferences and lifestyles while diversifying beyond traditional hotel rooms.

Investing in Travel Startups and Innovation

Travel tech accelerators and venture capital

If you’re looking for explosive growth potential, travel startups are where the magic happens. These are the disruptors—companies redefining how we book, explore, and experience the world. From AI-powered itinerary builders to blockchain-based booking platforms, the innovation in this space is electric.

Many of these startups go through accelerators or incubators tailored to travel tech, such as Plug and Play Travel or Welcome City Lab. These hubs provide not only funding but also access to mentors, investors, and real-world testing environments. Getting involved at this stage means being part of the next Airbnb, Skyscanner, or Hopper before they become household names.

For venture capitalists and angel investors, the ticket in might be higher—but so are the rewards. Some early-stage investors in major travel platforms saw returns in the hundreds, even thousands of percent. Even small investments in the right startup can lead to big wins when exit time rolls around.

Disruptive innovations reshaping the industry

Beyond the business model, it’s the innovations themselves that are turning heads. Augmented reality for sightseeing, AI for dynamic pricing, drones for hotel deliveries—there’s no shortage of creativity in travel. These aren’t gimmicks; they’re game-changers, especially as tech-savvy consumers demand smarter, faster, more personalized travel solutions.

Cryptocurrency payments, AI translators, and personalized VR tour previews are just a few innovations already in motion. These tools are removing friction points and enhancing the travel experience from planning to check-out. Businesses that embrace these technologies early will have a first-mover advantage—and that’s gold for investors.

By betting on innovation, you’re not just investing in companies—you’re investing in the future of travel itself. The only question is: Will you be ahead of the curve?

Government Support and Policy Frameworks

National tourism boards and tax incentives

Governments love tourism—it creates jobs, builds infrastructure, and brings in foreign currency. That’s why they’re willing to roll out the red carpet for tourism investors. National tourism boards often provide marketing support, land access, and even direct subsidies to attract new projects.

In many countries, particularly in Southeast Asia, Eastern Europe, and parts of Africa, tourism zones come with powerful incentives. We’re talking about zero corporate taxes for up to 10 years, duty-free imports on construction materials, and fast-tracked permitting processes.

These frameworks aren’t just reserved for huge hotel chains either. Even small investors building a boutique stay or eco-resort can tap into these benefits. As travel becomes more decentralized and niche-focused, the ability to partner with tourism authorities offers a competitive edge and a financial boost.

Global tourism alliances and policies

On the international level, organizations like the UNWTO (United Nations World Tourism Organization), the World Travel & Tourism Council (WTTC), and regional alliances are shaping tourism policy. These groups promote sustainable tourism, cross-border cooperation, and traveler protections—all of which benefit investors indirectly.

One exciting development is the emergence of regional travel bubbles and visa-free agreements, which can rapidly boost tourism in partner nations. When the ASEAN region introduced single-visa initiatives, for example, cross-border travel within Southeast Asia surged—driving hospitality and transport revenues sky-high.

Smart investors stay in tune with these global movements. Policy shifts can quickly open up or restrict new markets, and aligning your investments with government priorities means smoother operations and stronger long-term success.

Challenges and Risk Management

Economic downturns and geopolitical risks

Let’s not sugarcoat it—travel and tourism do come with risks. It’s one of the first sectors to take a hit during recessions or geopolitical turmoil. War, inflation, pandemics, and even natural disasters can cause travel plans (and profits) to grind to a halt.

However, savvy investors plan for this. Diversification—both geographically and across segments—is key. Investing in multiple types of travel services (e.g., budget, luxury, business, local) or targeting different demographics can buffer you against localized downturns.

Insurance also plays a big role. From property insurance on resorts to travel interruption policies, risk can be mitigated with the right tools. Many seasoned investors also work closely with geopolitical analysts and international consultants to assess new markets before jumping in.

Climate change and over-tourism management

Climate change poses a dual challenge—it threatens key travel destinations and also forces stricter regulations. Rising sea levels, heatwaves, and environmental degradation can make popular spots unviable over time. For investors, this means assessing long-term sustainability before pouring money into beach resorts or ski lodges.

Over-tourism is another growing concern. Cities like Venice and Barcelona are already imposing tourist caps and entry fees to protect their infrastructure and residents. While this can reduce overcrowding, it also means a cap on revenues unless innovation (like staggered bookings or off-peak marketing) is applied.

The good news? Awareness of these risks has led to smarter planning and better resource use. Sustainable travel investments that balance profitability with responsibility are now favored by both travelers and governments. The more responsibly you invest, the more sustainable your profits will be.

Future Trends and Long-Term Outlook

The rise of space tourism and luxury expeditions

Space tourism is no longer the stuff of sci-fi movies. Companies like SpaceX, Blue Origin, and Virgin Galactic are already launching civilians into orbit—and it’s just the beginning. What started as billionaire joyrides is slowly morphing into a legitimate luxury travel market. And though the buy-in is still astronomical (pun intended), the potential returns are even higher.

This signals the next era of ultra-premium tourism. Beyond space, think deep-sea explorations, Antarctica cruises, and multi-continent private jet journeys. These aren’t vacations—they’re bucket-list experiences. And with the ultra-rich seeking novelty more than luxury, these extreme expeditions are gaining traction.

For investors, the lesson is clear: high-end experiences with limited access create immense demand and loyalty. Even if you’re not ready to buy a rocket seat, investing in the tech, logistics, or service providers that support luxury travel can be a high-flying opportunity with serious payoff.

Hybrid travel, bleisure, and wellness tourism

As work-from-anywhere becomes the new normal, a new kind of traveler has emerged: the hybrid traveler. These are people who mix business with leisure (“bleisure”) and often extend their stays to explore destinations after work engagements. This shift is prompting hotels to include coworking spaces, offer extended stay discounts, and partner with wellness brands.

Wellness tourism is another booming trend. Travelers are seeking holistic experiences—spa retreats, yoga getaways, detox centers, and mental health resorts. In fact, wellness tourism is growing nearly twice as fast as general tourism, with projections hitting over $1 trillion globally by 2030.

Investors who adapt to these trends—by funding hybrid hotels, wellness brands, or health-centric travel packages—are setting themselves up for sustained success. The modern traveler isn’t just moving—they’re transforming, and your investments can transform right alongside them.

Conclusion: Why Travel and Tourism Should Be on Every Investor’s Radar

In a world of volatility, the travel and tourism industry continues to shine as a dynamic and rewarding investment arena. It’s not just about plane tickets and hotel rooms anymore—it’s a complex ecosystem powered by experiences, innovation, culture, and connection. Whether it’s a luxury resort in the Maldives, a travel tech startup in Berlin, or a remote co-living space in Bali, opportunities are everywhere.

The best part? You’re not just investing in profit—you’re investing in people’s dreams. Travel enriches lives, creates jobs, bridges cultures, and preserves heritage. Your investment can be the catalyst that turns a quiet village into a thriving destination, or a bold idea into the next big platform.

So if you’re looking for a sector that offers growth, diversity, emotion, and impact, tourism checks every box. With careful planning, strong partnerships, and a finger on the pulse of emerging trends, investing in travel and tourism isn’t just smart—it’s visionary.

FAQs

1. Is investing in travel and tourism safe in uncertain times?

While no investment is entirely risk-free, tourism has proven to be incredibly resilient. With proper diversification and risk management, it offers solid long-term returns even after downturns.

2. What are the best ways to start investing in tourism with a small budget?

You can begin with REITs related to hotels, buy shares in travel-tech companies, or co-invest in short-term rental properties. Platforms like Airbnb make it easier than ever to start small and scale up.

3. How can I ensure my tourism investment is sustainable and eco-friendly?

Look for green-certified projects, eco-lodges, and businesses aligned with ESG values. You can also fund carbon offset programs or support ethical wildlife and cultural experiences.

4. Are there countries that are better for tourism investment?

Yes, countries like Portugal, Thailand, Indonesia, and Costa Rica offer attractive incentives, strong tourism growth, and supportive legal frameworks for foreign investors.

5. Can I invest in travel without owning physical property?

Absolutely. You can invest in travel tech startups, stocks of travel companies, mutual funds focused on tourism, or even travel-focused ETFs. There are plenty of options beyond bricks and mortar.